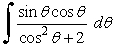

Evaluate  .

.

Definitions:

Marginal Tax Rate

The tax rate applied to the next dollar of taxable income, indicating the percentage of tax paid on any additional dollar earned.

Total Income

The sum of all earnings obtained from work, investments, and other sources before any deductions.

Total Taxes

The combined amount of all taxes levied by a government on individuals, corporations, and other entities.

Tax Rate Structure

The organization of tax rates into different brackets or categories, which determines the amount of tax levied on income, property, sales, etc.

Q7: Answer true or false. The curves y

Q21: Solve the differential equation using any method

Q34: An object in deep space is initially

Q42: Answer true or false. If <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6988/.jpg"

Q113: Find the fluid pressure on the

Q114: Use the Endpaper Integral Table to evaluate

Q172: A particle moves along the s-axis. Use

Q220: Use cylindrical shells to find the volume

Q236: For <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6988/.jpg" alt="For ,

Q287: Determine whether or not the following series