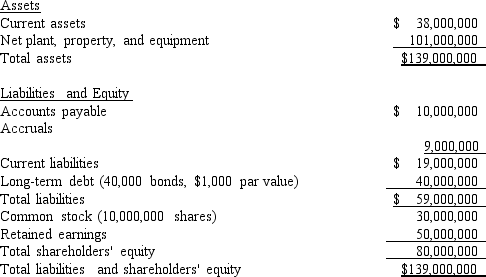

Exhibit 9.1

The Collins Group, a leading producer of custom automobile accessories, has hired you to estimate the firm's weighted average cost of capital. The balance sheet and some other information are provided below.

The stock is currently selling for $15.25 per share, and its noncallable $1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 40%.

-Refer to Exhibit 9.1.Based on the CAPM,what is the firm's cost of common stock?

Definitions:

Long-Run Adjustments

Long-run adjustments are changes made by firms or industries in response to shifts in market conditions over a longer period, involving variations in production levels and the entry or exit of firms.

Market Price

The present cost at which a service or asset is available for purchase or sale in a specific market.

Downward Sloping

Describes a line on a graph that shows a decrease in one variable as another variable increases, commonly used in economics to illustrate demand curves.

Representative Firms

Firms selected as typical or average examples of a broader industry or sector, often used for analysis or benchmarking.

Q5: Firms hold cash balances in order to

Q8: Variance is a measure of the variability

Q16: A basic rule in capital budgeting is

Q18: Monar Inc.'s CFO would like to decrease

Q21: A firm's peak borrowing needs will probably

Q30: Which of the following statements is CORRECT?<br>A)

Q36: Bonds A and B are 15-year,$1,000 face

Q40: Suppose Walker Publishing Company is considering bringing

Q61: Since depreciation is a non-cash charge,it neither

Q73: If debt is to be used to