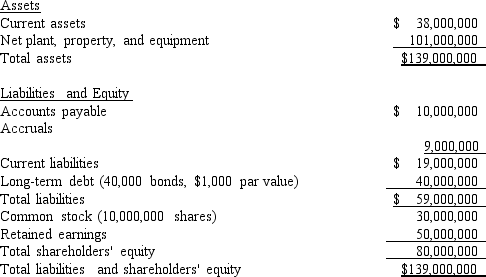

Exhibit 9.1

The Collins Group, a leading producer of custom automobile accessories, has hired you to estimate the firm's weighted average cost of capital. The balance sheet and some other information are provided below.

The stock is currently selling for $15.25 per share, and its noncallable $1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 40%.

-Refer to Exhibit 9.1.Which of the following is the best estimate for the weight of debt for use in calculating the firm's WACC?

Definitions:

Palaces

Grand, opulent residences for royalty, nobility, or bishops, often showcasing elaborate architecture, expansive grounds, and rich decorations to signify wealth and power.

Cretan

Pertaining to Crete, its people, culture, or history, often associated with the ancient Minoan civilization.

Mycenaean

The prehistoric art of the Late Helladic period in Greece, named after the citadel of Mycenae.

Minoan Art

An artistic tradition from the ancient Minoan civilization on Crete, known for its vibrant frescoes, pottery, and sculptures that reflect a society rich in maritime culture and mythology.

Q5: McLeod Inc.is considering an investment that has

Q8: If the market is in equilibrium,then an

Q41: As the text indicates,a firm's financial risk

Q56: Cash is often referred to as a

Q64: As a rule,managers should try to always

Q72: Under normal conditions,which of the following would

Q77: Synchronization of cash flows is an important

Q92: Last month,Standard Systems analyzed the project

Q94: Both the regular and the modified IRR

Q124: Which of the following statements is most