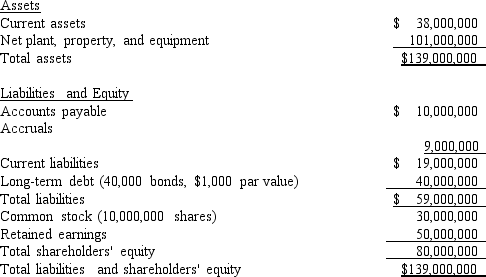

Exhibit 9.1

The Collins Group, a leading producer of custom automobile accessories, has hired you to estimate the firm's weighted average cost of capital. The balance sheet and some other information are provided below.

The stock is currently selling for $15.25 per share, and its noncallable $1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 40%.

-Refer to Exhibit 9.1.What is the best estimate of the firm's WACC?

Definitions:

Overreliance

A situation where there is excessive dependence on a particular resource, tool, or strategy, often leading to vulnerability or failure when it is unavailable or ineffective.

Knowledge Base

The structured collection of information, facts, and principles that an individual or system possesses, often related to a specific topic or field.

Qualitative Designs

Research methodologies that focus on gathering non-numerical data to understand concepts, perceptions, or experiences.

Quantitative Approaches

Research methods focusing on the collection and analysis of numerical data to understand patterns, relationships, and causality.

Q4: Companies with relatively high assets-to-sales ratios require

Q7: Assume that two investors each hold a

Q10: If the information content,or signaling,hypothesis is correct,then

Q20: Taylor Inc.,the company you work for,is

Q51: A portfolio's risk is measured by the

Q51: For bonds,price sensitivity to a given change

Q61: It is extremely difficult to estimate the

Q65: Fiske Roofing Supplies' stock has a beta

Q66: Stocks A and B have the

Q122: Assume that investors have recently become more