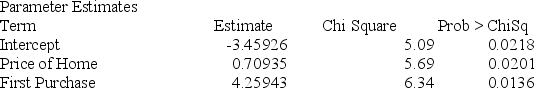

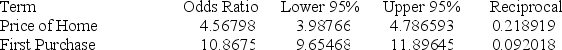

Below gives the data concerning (1) the dependent variable Default which equals 1 if a customer defaults on their loan and 0 if they do not; (2) the independent variable Price of Home, which is the price of the home (in tens) and (3) the independent variable First Purchase which equals 0 if the customer has owned a home before and 1 if this is their first home. Identify and interpret the odds ratio estimate for First Purchase.

Definitions:

Premium Amortization

Premium amortization is the gradual reduction of the premium paid above the par value of a bond, allocated over the bond's life.

Bond Premium

The amount by which the market price of a bond exceeds its face value, typically occurring when the bond's interest rate is higher than the current market interest rate.

Interest Expense

The cost incurred by an entity for borrowed funds, which is considered a non-operating expense shown on the income statement.

Face Value

The nominal or dollar value printed on a security or a financial instrument, such as a bond or stock, representing its legal worth.

Q14: Use the following price information for three

Q18: In one-way ANOVA, the total sum of

Q19: A simple index is obtained by dividing

Q39: The HR manager of a major office

Q53: When the quadratic regression model y =

Q67: A _ is a diagram that assists

Q68: As the difference between observed frequency and

Q70: Linear regression requires the assumptions of independence,

Q71: Consider a time series with 15 quarterly

Q122: The _ of the simple linear regression