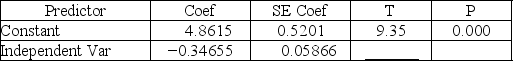

Consider the following partial computer output from a simple linear regression analysis.

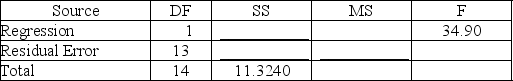

S = .4862R-Sq = ________

S = .4862R-Sq = ________

Analysis of Variance

Calculate the t statistic used to test H0: β1 = 0 versus Ha: β1 ≠ 0 at α = .001.

Calculate the t statistic used to test H0: β1 = 0 versus Ha: β1 ≠ 0 at α = .001.

Definitions:

Net Present Value (NPV)

A financial metric that calculates the difference between the present value of cash inflows and outflows over a period of time. It is used to assess the profitability of an investment.

Weighted Average Cost of Capital (WACC)

This metric calculates a firm's cost of capital, considering the proportionate costs of each component of the capital structure.

Internal Rate of Return (IRR)

The discount rate at which the net present value of all cash flows (positive and negative) from a project or investment equals zero.

Weighted Average Cost of Capital (WACC)

WACC represents the average rate that a company is expected to pay to finance its assets, weighted by the proportion of debt and equity financing.

Q26: In the quadratic regression model y =

Q30: Consider the following partial analysis of variance

Q32: The _ is the proportion of the

Q33: Causal variables can be used in forecasting

Q34: When we test H<sub>0</sub>: μ<sub>1</sub> ≤ μ<sub>2</sub>,

Q42: Assumptions of a regression model can be

Q48: In multiple regression analysis, a desirable residual

Q58: A study was conducted to investigate the

Q88: What is the degrees of freedom error

Q127: The registrar at a state college is