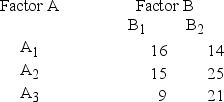

Consider the 3 × 2 contingency table below.

At a significance level of .05, test H0: the factors A and B are independent.

At a significance level of .05, test H0: the factors A and B are independent.

Definitions:

Standard Cost Variances

The differences between the expected (standard) costs of goods or services and the actual costs incurred.

Contribution Margin Ratio

A financial metric indicating the percentage of each sales dollar that contributes to covering fixed costs and generating profit.

Common Fixed Costs

Costs that do not change in total regardless of changes in the level of activity or volume of output and are shared among multiple products or departments.

Accounting Records

Documents and books that systematically record all financial transactions of an entity, providing a foundation for financial statements and tax returns.

Q6: The confusion matrix helps you assess your

Q9: A cereal manufacturer is concerned that the

Q14: The odds of an event occurring is

Q63: We have just performed a one-way ANOVA

Q72: In performing a chi-square goodness-of-fit test for

Q77: In performing a chi-square goodness-of-fit test with

Q78: A company has developed a new ink-jet

Q103: In a contingency table, if all of

Q110: On the most recent tax cut proposal,

Q129: Calculate the pooled variance where sample 1