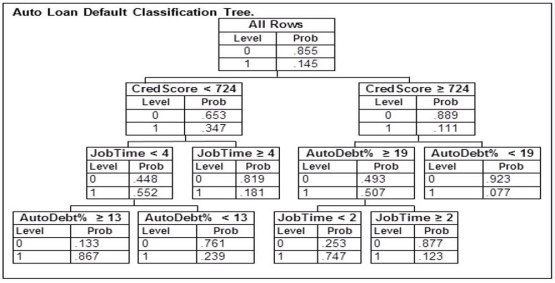

An automobile finance company analyzed a sample of recent automobile loans to try to determine key factors in identifying borrowers who would be likely to default on their auto loan. The response variable Default equals 1 if the borrower defaulted during the term of the loan and 0 otherwise. The predictor variable AutoDebt% was the ratio (expressed as a percent) of the required loan payments to the borrower's take-home income at the time of purchase. JobTime was the number of years the borrower had worked at their current job at the time of purchase. CredScore was the borrower's credit score at the time of purchase. Below is part of the classification tree the finance company derived from the data collected in the study. Assume they classify those with a default probability estimate of at least .5 as Defaulters.  Based on this classification tree, a member of the study sample who had a credit score of 537, been at their current job for 12 years, took out a loan with payments equaling 16% of their income, and defaulted would be

Based on this classification tree, a member of the study sample who had a credit score of 537, been at their current job for 12 years, took out a loan with payments equaling 16% of their income, and defaulted would be

Definitions:

Par Value

Par value is a nominal value assigned to a security or stock as stated in its corporate charter, often used to determine legal capital or face value.

Journal Entry

A record in accounting that represents a transaction and its effect on accounts.

IFRS

International Financial Reporting Standards, which are a set of accounting standards developed by the International Accounting Standards Board (IASB) that guide the preparation of financial statements globally.

Convertible Notes

A form of short-term debt that converts into equity, typically in conjunction with a future financing round, under specific terms.

Q9: A low response rate has no effect

Q24: As the sample size _, the variation

Q49: A classification tree is useful for predicting

Q56: Find P( <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7056/.jpg" alt="Find P(

Q61: Consider two population distributions labeled A and

Q68: Suppose that a bank wishes to predict

Q97: It is possible to create different interpretations

Q101: In a hearing test, randomly selected subjects

Q137: The following frequency table summarizes the ages

Q142: A fair die is rolled 10 times.