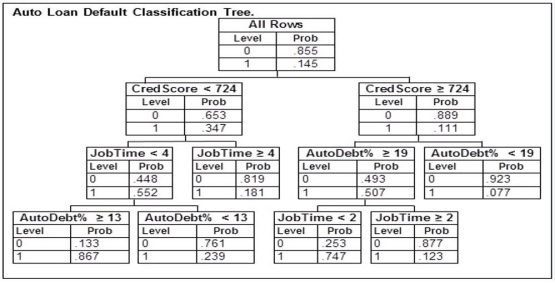

An automobile finance company analyzed a sample of recent automobile loans to try to determine key factors in identifying borrowers who would be likely to default on their auto loan. The response variable Default equals 1 if the borrower defaulted during the term of the loan and 0 otherwise. The predictor variable AutoDebt% was the ratio (expressed as a percent) of the required loan payments to the borrower's take-home income at the time of purchase. JobTime was the number of years the borrower had worked at their current job at the time of purchase. CredScore was the borrower's credit score at the time of purchase. Below is part of the classification tree the finance company derived from the data collected in the study. Assume they classify those with a default probability estimate of at least .5 as Defaulters.  Based on this classification tree, a member of the study sample who had a credit score of 423, been at their current job for 4 years, took out a loan with payments equaling 22% of their income, and did not default would be

Based on this classification tree, a member of the study sample who had a credit score of 423, been at their current job for 4 years, took out a loan with payments equaling 22% of their income, and did not default would be

Definitions:

Per-Unit Costs

The average cost for each individual unit of product produced, taking into account all fixed and variable expenses.

Marginal Costs

The incremental cost involved in producing one more unit of a product or service.

Learning Curve

The concept that people improve efficiency and decrease cost over time as they gain experience in a particular task or operation.

Marginal Productivity

The additional output that is produced by using one more unit of a particular input while keeping other inputs constant.

Q18: Three companies produce all the potato chips

Q18: The range of the measurement is the

Q40: Recently an advertising company called 200 people

Q63: The probability that an appliance is currently

Q79: A cable television company has randomly selected

Q101: The number of items rejected daily by

Q129: The set of all possible outcomes for

Q130: The standard deviation of a discrete random

Q138: Container 1 has 8 items, 3 of

Q140: A card is drawn from a standard