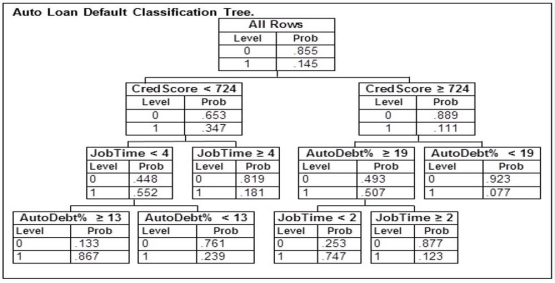

An automobile finance company analyzed a sample of recent automobile loans to try to determine key factors in identifying borrowers who would be likely to default on their auto loan. The response variable Default equals 1 if the borrower defaulted during the term of the loan and 0 otherwise. The predictor variable AutoDebt% was the ratio (expressed as a percent) of the required loan payments to the borrower's take-home income at the time of purchase. JobTime was the number of years the borrower had worked at their current job at the time of purchase. CredScore was the borrower's credit score at the time of purchase. Below is part of the classification tree the finance company derived from the data collected in the study. Assume they classify those with a default probability estimate of at least .5 as Defaulters.  A potential borrower with a credit score of 523 who has been at their current job for 1 year is applying for a loan with payments equaling 17% of their income. Based on this classification tree, the best estimate of the probability that this loan applicant would default would be

A potential borrower with a credit score of 523 who has been at their current job for 1 year is applying for a loan with payments equaling 17% of their income. Based on this classification tree, the best estimate of the probability that this loan applicant would default would be

Definitions:

Environmental-Change Strategies

Approaches and methods adopted by organizations or individuals to adapt to or mitigate the effects of changes in the environment, aiming for sustainability and reduced ecological impact.

Governmental Regulations

Laws and rules established by governments to regulate behaviors, activities, and standards in various industries and society at large.

Supply Chain Sustainability

The management of environmental, social, and economic impacts within the supply chain, focusing on long-term viability and ethics.

Legal Obligations

Responsibilities or duties enforced by law that an entity or individual must follow.

Q9: The local amusement park was interested in

Q33: For a binomial process, the probability of

Q53: A real estate appraiser is gathering housing

Q69: If the number of surface nonconformities on

Q95: Suppose that a bank wishes to predict

Q95: As the sample size increases, the variability

Q112: A continuous probability distribution having a rectangular

Q127: Every current applicant for a position in

Q133: In a study conducted for the state

Q142: Consider a standard deck of 52 playing