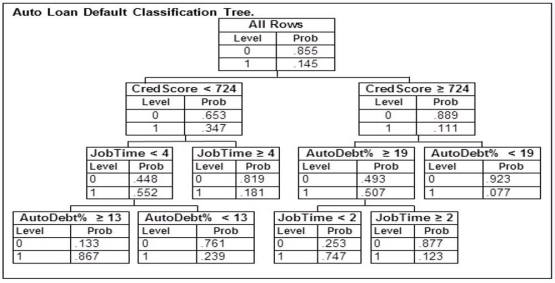

An automobile finance company analyzed a sample of recent automobile loans to try to determine key factors in identifying borrowers who would be likely to default on their auto loan. The response variable Default equals 1 if the borrower defaulted during the term of the loan and 0 otherwise. The predictor variable AutoDebt% was the ratio (expressed as a percent) of the required loan payments to the borrower's take-home income at the time of purchase. JobTime was the number of years the borrower had worked at their current job at the time of purchase. CredScore was the borrower's credit score at the time of purchase. Below is part of the classification tree the finance company derived from the data collected in the study. Assume they classify those with a default probability estimate of at least .5 as Defaulters.  A potential borrower with a credit score of 743 who has been at their current job for 3 years is applying for a loan with payments equaling 12% of their income. Based on this classification tree, the best estimate of the probability that this loan applicant would default would be

A potential borrower with a credit score of 743 who has been at their current job for 3 years is applying for a loan with payments equaling 12% of their income. Based on this classification tree, the best estimate of the probability that this loan applicant would default would be

Definitions:

Correspondence

In communication, it refers to the exchange of messages or information between two or more parties either through speaking, writing, or using some other medium.

Attitudes And Behaviour

The study of the relationship between people's evaluative orientations and their actions, emphasizing how attitudes can influence or predict behavior.

Perceived Behavioural Control

An individual's belief about the ease or difficulty of performing a particular behavior, influenced by the resources and obstacles anticipated.

Theory Of Planned Behaviour

Modification by Ajzen of the theory of reasoned action. It suggests that predicting a behaviour from an attitude measure is improved if people believe they have control over that behaviour.

Q2: Which of the following is the best

Q14: If the mean is greater than the

Q34: An internet service provider (ISP) has randomly

Q68: Suppose that 60 percent of the voters

Q80: Data drill down is a form of

Q100: The following is a relative frequency distribution

Q107: At an oceanside nuclear power plant, seawater

Q110: Consider a normal population with a mean

Q115: If x is a Poisson random variable

Q136: The number of ways to arrange x