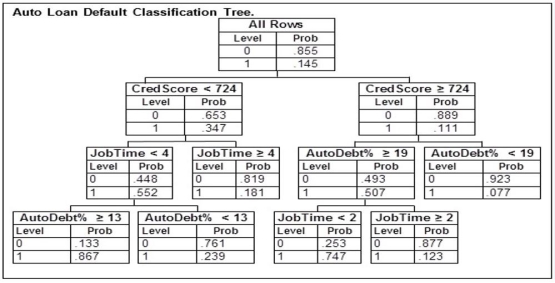

An automobile finance company analyzed a sample of recent automobile loans to try to determine key factors in identifying borrowers who would be likely to default on their auto loan. The response variable Default equals 1 if the borrower defaulted during the term of the loan and 0 otherwise. The predictor variable AutoDebt% was the ratio (expressed as a percent) of the required loan payments to the borrower's take-home income at the time of purchase. JobTime was the number of years the borrower had worked at their current job at the time of purchase. CredScore was the borrower's credit score at the time of purchase. Below is part of the classification tree the finance company derived from the data collected in the study. Assume they classify those with a default probability estimate of at least .5 as Defaulters.  A potential borrower with a credit score of 668 who has just started their current job is applying for a loan with payments equaling 7% of their income. Based on this classification tree, the best estimate of the probability that this loan applicant would default would be ________.

A potential borrower with a credit score of 668 who has just started their current job is applying for a loan with payments equaling 7% of their income. Based on this classification tree, the best estimate of the probability that this loan applicant would default would be ________.

Definitions:

Employment and Education

The interconnected relationship between one's job opportunities and their level of education, affecting economic status and social mobility.

LGBTQ Rights

The advocacy and movements aimed at establishing and protecting rights and societal acceptance for people who identify as lesbian, gay, bisexual, transgender, or queer/questioning.

Genetic Origin

The biological lineage or ancestry from which an organism's genetic traits are derived.

Sexual Orientation

An enduring pattern of emotional, romantic, or sexual attractions to men, women, or both sexes, as well as the absence of such attractions.

Q17: According to Chebyshev's theorem, a range of

Q40: Recently an advertising company called 200 people

Q43: A(n) _ is a graph of a

Q64: An MBA admissions officer wishes to predict

Q94: The internal auditing staff of a local

Q113: In the first step of setting up

Q120: In a statistics class, 10 scores were

Q137: The following frequency table summarizes the ages

Q139: The Securities and Exchange Commission has determined

Q145: The Securities and Exchange Commission has determined