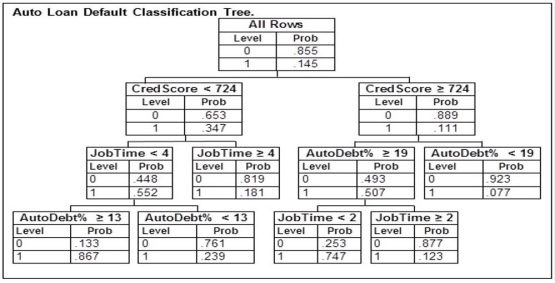

An automobile finance company analyzed a sample of recent automobile loans to try to determine key factors in identifying borrowers who would be likely to default on their auto loan. The response variable Default equals 1 if the borrower defaulted during the term of the loan and 0 otherwise. The predictor variable AutoDebt% was the ratio (expressed as a percent) of the required loan payments to the borrower's take-home income at the time of purchase. JobTime was the number of years the borrower had worked at their current job at the time of purchase. CredScore was the borrower's credit score at the time of purchase. Below is part of the classification tree the finance company derived from the data collected in the study. Assume they classify those with a default probability estimate of at least .5 as Defaulters.  A potential borrower with a credit score of 723 who has been at their current job for 7 years is applying for a loan with payments equaling 11% of their income. Based on this classification tree, the best estimate of the probability that this loan applicant would default would be ________.

A potential borrower with a credit score of 723 who has been at their current job for 7 years is applying for a loan with payments equaling 11% of their income. Based on this classification tree, the best estimate of the probability that this loan applicant would default would be ________.

Definitions:

Aggressive Acts

Acts characterized by hostility or violence towards others.

Evolutionary

Pertaining to the process by which organisms change over generations due to inherited traits, natural selection, and adaptation.

Cognitive

Relating to mental processes involved in perception, memory, judgment, and reasoning.

Dispositional Patterns

Enduring characteristics and behaviors that individuals consistently demonstrate across different situations.

Q9: Consider a Poisson distribution with an average

Q15: During the past six months, 73.2 percent

Q22: Fill in the missing components of the

Q43: In a study of the factors that

Q54: Because different classification techniques will perform better

Q65: The Securities and Exchange Commission has determined

Q65: If the random variable x is normally

Q102: A pharmaceutical company has determined that if

Q117: A disadvantage of using grouping (a frequency

Q148: Determine whether these two events are mutually