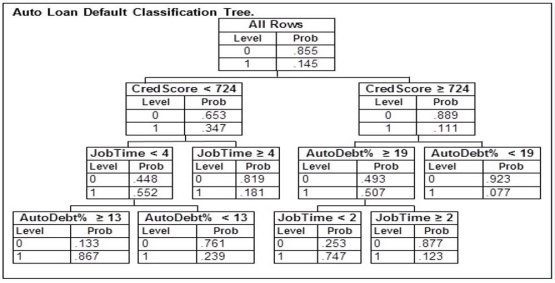

An automobile finance company analyzed a sample of recent automobile loans to try to determine key factors in identifying borrowers who would be likely to default on their auto loan. The response variable Default equals 1 if the borrower defaulted during the term of the loan and 0 otherwise. The predictor variable AutoDebt% was the ratio (expressed as a percent) of the required loan payments to the borrower's take-home income at the time of purchase. JobTime was the number of years the borrower had worked at their current job at the time of purchase. CredScore was the borrower's credit score at the time of purchase. Below is part of the classification tree the finance company derived from the data collected in the study. Assume they classify those with a default probability estimate of at least .5 as Defaulters.  A potential borrower with a credit score of 717 who has been at their current job for 3 years is considering applying for a loan. They do not yet have a particular loan amount in mind. Based on this classification tree, the best estimate that this loan applicant would default would be ________.

A potential borrower with a credit score of 717 who has been at their current job for 3 years is considering applying for a loan. They do not yet have a particular loan amount in mind. Based on this classification tree, the best estimate that this loan applicant would default would be ________.

Definitions:

Myers-Briggs Type Indicator

A psychological assessment tool that categorizes individuals into 16 personality types based on preferences in how they perceive the world and make decisions.

Jung's Psychological Types

A theory proposed by Carl Jung that categorizes individuals according to their preference in using their mental capacities, such as thinking vs. feeling or sensing vs. intuition.

Inconclusive

Describes results or data that do not clearly support a specific outcome, decision, or understanding, often indicating the need for further investigation.

Self-Enhancement

The tendency to focus on and exaggerate the positive aspects of oneself for a better self-image.

Q9: Consider a Poisson distribution with an average

Q22: A cable television company has randomly selected

Q29: If there are 130 values in a

Q33: Employees of a local university have been

Q42: The cumulative frequency for a class will

Q93: Four employees who work as drive-through attendants

Q100: The probability distribution of X is <img

Q100: The following is a relative frequency distribution

Q101: Historical data show that the average number

Q141: The lifetime of a stereo component is