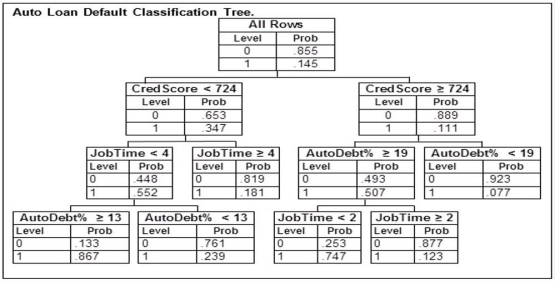

An automobile finance company analyzed a sample of recent automobile loans to try to determine key factors in identifying borrowers who would be likely to default on their auto loan. The response variable Default equals 1 if the borrower defaulted during the term of the loan and 0 otherwise. The predictor variable AutoDebt% was the ratio (expressed as a percent) of the required loan payments to the borrower's take-home income at the time of purchase. JobTime was the number of years the borrower had worked at their current job at the time of purchase. CredScore was the borrower's credit score at the time of purchase. Below is part of the classification tree the finance company derived from the data collected in the study. Assume they classify those with a default probability estimate of at least .5 as Defaulters.  A potential borrower with a credit score of 792 who has been at their current job for 1 year and has a monthly income of $3,000 would like to apply for a loan. To be approved for the loan they would need to be classified as a non-Defaulter. Of the following monthly payments, which is the highest this loan could have to be approved for this potential borrower?

A potential borrower with a credit score of 792 who has been at their current job for 1 year and has a monthly income of $3,000 would like to apply for a loan. To be approved for the loan they would need to be classified as a non-Defaulter. Of the following monthly payments, which is the highest this loan could have to be approved for this potential borrower?

Definitions:

Life Estate

A property interest that lasts for the lifetime of a specific individual, after which the property passes to another recipient.

Joint Tenancy

A form of property co-ownership that provides each tenant with an equal share and rights in the property, with the provision of right of survivorship.

Enforceable

A quality of law or agreement that allows it to be legally imposed or acted upon, ensuring compliance.

Written

The form of expression that uses letters of the alphabet or characters to convey information or ideas on a tangible medium.

Q4: Consider a normal population with a mean

Q5: If we sample without replacement, we do

Q14: An MBA admissions officer wishes to predict

Q38: The number of calls coming into a

Q40: An ad agency is developing a campaign

Q78: A study conducted by a local university

Q80: During the past six months, 73.2 percent

Q100: One approach to avoid overfitting a classification

Q126: The weight of a product is normally

Q138: An important part of the customer service