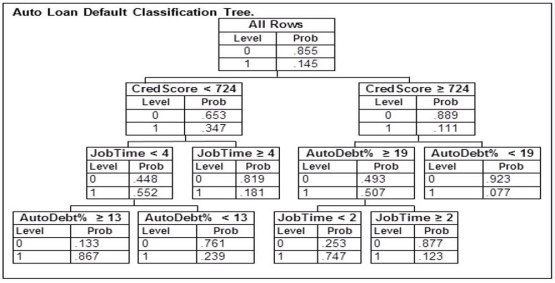

An automobile finance company analyzed a sample of recent automobile loans to try to determine key factors in identifying borrowers who would be likely to default on their auto loan. The response variable Default equals 1 if the borrower defaulted during the term of the loan and 0 otherwise. The predictor variable AutoDebt% was the ratio (expressed as a percent) of the required loan payments to the borrower's take-home income at the time of purchase. JobTime was the number of years the borrower had worked at their current job at the time of purchase. CredScore was the borrower's credit score at the time of purchase. Below is part of the classification tree the finance company derived from the data collected in the study. Assume they classify those with a default probability estimate of at least .5 as Defaulters.  Based on this classification tree, a member of the study sample who had a credit score of 537, been at their current job for 12 years, took out a loan with payments equaling 16% of their income, and defaulted would be

Based on this classification tree, a member of the study sample who had a credit score of 537, been at their current job for 12 years, took out a loan with payments equaling 16% of their income, and defaulted would be

Definitions:

Underestimate

To judge something below its actual value, importance, or strength.

Procrastination

The act of delaying or postponing tasks, often leading to stress, anxiety, or reduced performance.

Physiological State

The condition of the body's normal functions and processes, which can be influenced by factors like health, exercise, and stress.

Skin Resistance

A measure of the skin's ability to resist electrical current, often used in psychophysiological research to gauge emotional or stress responses.

Q1: The yearly proportional return for stock G

Q14: If the mean is greater than the

Q26: If we have a sample size of

Q55: The local amusement park was interested in

Q56: A cable television company has randomly selected

Q59: Quality control is an important issue at

Q104: Suppose that you believe that the probability

Q110: The Post Office has established a record

Q111: A correlation coefficient is a unitless measure

Q112: A plot that allows us to visualize