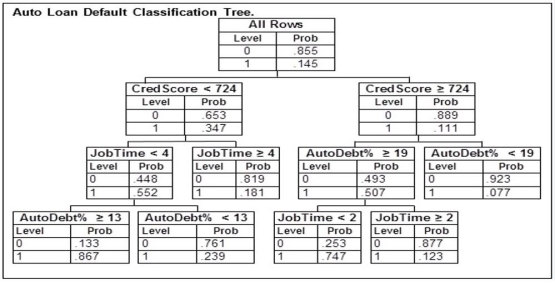

An automobile finance company analyzed a sample of recent automobile loans to try to determine key factors in identifying borrowers who would be likely to default on their auto loan. The response variable Default equals 1 if the borrower defaulted during the term of the loan and 0 otherwise. The predictor variable AutoDebt% was the ratio (expressed as a percent) of the required loan payments to the borrower's take-home income at the time of purchase. JobTime was the number of years the borrower had worked at their current job at the time of purchase. CredScore was the borrower's credit score at the time of purchase. Below is part of the classification tree the finance company derived from the data collected in the study. Assume they classify those with a default probability estimate of at least .5 as Defaulters.  Based on this classification tree, a member of the study sample who had a credit score of 786, just started their current job, took out a loan with payments equaling 9% of their income, and defaulted would be

Based on this classification tree, a member of the study sample who had a credit score of 786, just started their current job, took out a loan with payments equaling 9% of their income, and defaulted would be

Definitions:

Three-Field System

An agricultural practice where farmland was divided into three sections, with different crops rotated annually to manage soil fertility.

Fertility

The natural capability to produce offspring, a significant factor in population dynamics and individual reproductive health.

Unplanted

Not sown with seeds or not having plants introduced into the ground or an area intended for cultivation.

Differing Languages

The variation and diversity of languages across different populations or geographical regions.

Q21: An automobile finance company analyzed a sample

Q43: The _ of an event is a

Q44: _ and _ are used to describe

Q61: Consider two population distributions labeled A and

Q78: The weight of a product is normally

Q81: A stem-and-leaf display is best used to

Q90: The average lateness for one of the

Q96: The first step to constructing a normal

Q99: An internet service provider (ISP) has randomly

Q124: When sample size is 11, find t<sub>.001</sub>.