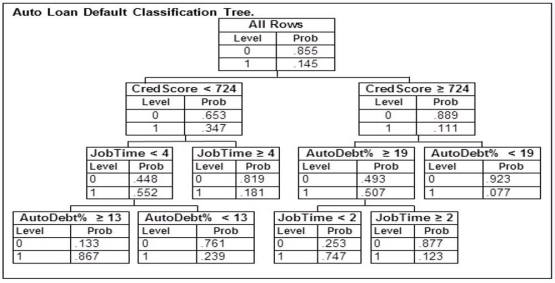

An automobile finance company analyzed a sample of recent automobile loans to try to determine key factors in identifying borrowers who would be likely to default on their auto loan. The response variable Default equals 1 if the borrower defaulted during the term of the loan and 0 otherwise. The predictor variable AutoDebt% was the ratio (expressed as a percent) of the required loan payments to the borrower's take-home income at the time of purchase. JobTime was the number of years the borrower had worked at their current job at the time of purchase. CredScore was the borrower's credit score at the time of purchase. Below is part of the classification tree the finance company derived from the data collected in the study. Assume they classify those with a default probability estimate of at least .5 as Defaulters.  A potential borrower with a credit score of 743 who has been at their current job for 3 years is applying for a loan with payments equaling 12% of their income. Based on this classification tree, the best estimate of the probability that this loan applicant would default would be

A potential borrower with a credit score of 743 who has been at their current job for 3 years is applying for a loan with payments equaling 12% of their income. Based on this classification tree, the best estimate of the probability that this loan applicant would default would be

Definitions:

Emotional Information

Data related to feelings or affective states that can influence cognition and behavior.

Temporal Lobe

A region of the cerebral cortex located beneath the lateral fissure on both cerebral hemispheres, associated with processing auditory information and encoding memory.

Hearing

The ability to perceive sound by detecting vibrations through an organ such as the ear.

Temporal Lobe

A region of the cerebral cortex involved in auditory perception, language comprehension, and memory formation.

Q7: A company's Chief Operating Officer (COO) keeps

Q18: The weight of a product is normally

Q49: While conducting experiments, a marine biologist selects

Q55: Which of the following statements is not

Q64: An MBA admissions officer wishes to predict

Q75: A manufacturer of personal computers tests competing

Q80: A pair of dice is thrown. What

Q112: Researchers wish to study fuel consumption rates

Q133: Determine whether these two events are mutually

Q137: A vaccine is 95 percent effective. What