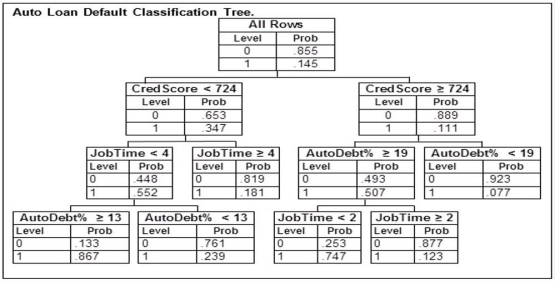

An automobile finance company analyzed a sample of recent automobile loans to try to determine key factors in identifying borrowers who would be likely to default on their auto loan. The response variable Default equals 1 if the borrower defaulted during the term of the loan and 0 otherwise. The predictor variable AutoDebt% was the ratio (expressed as a percent) of the required loan payments to the borrower's take-home income at the time of purchase. JobTime was the number of years the borrower had worked at their current job at the time of purchase. CredScore was the borrower's credit score at the time of purchase. Below is part of the classification tree the finance company derived from the data collected in the study. Assume they classify those with a default probability estimate of at least .5 as Defaulters.  A potential borrower with a credit score of 792 who has been at their current job for 1 year and has a monthly income of $3,000 would like to apply for a loan. To be approved for the loan they would need to be classified as a non-Defaulter. Of the following monthly payments, which is the highest this loan could have to be approved for this potential borrower?

A potential borrower with a credit score of 792 who has been at their current job for 1 year and has a monthly income of $3,000 would like to apply for a loan. To be approved for the loan they would need to be classified as a non-Defaulter. Of the following monthly payments, which is the highest this loan could have to be approved for this potential borrower?

Definitions:

Mixed Cost

A cost consisting both of variable and fixed components, which changes in total in response to changes in activity level but not necessarily in direct proportion.

Least-squares Regression

A method in statistics for finding the optimal line of fit by minimizing the sum of the squared deviations between real and estimated values.

Maintenance Cost

The expenses incurred to keep machinery, equipment, or buildings in operating condition and repair.

Machine-hours

An indicator of the duration for which equipment is utilized in the manufacturing process, commonly employed for distributing manufacturing overhead costs.

Q6: The weight of a product is normally

Q21: An automobile finance company analyzed a sample

Q31: A worldwide personal products manufacturer is working

Q38: Find P( <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7056/.jpg" alt="Find P(

Q53: Pareto charts are frequently used to identify

Q54: Because different classification techniques will perform better

Q76: A company's Chief Operating Officer (COO) keeps

Q95: All continuous random variables are normally distributed.

Q137: At a college, 70 percent of the

Q146: What is the probability of rolling a