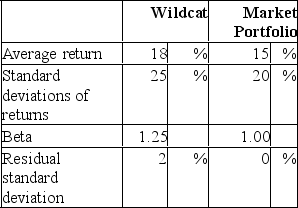

The following data are available relating to the performance of Wildcat Fund and the market portfolio:  The risk-free return during the sample period was 7%.

The risk-free return during the sample period was 7%.

Calculate Jensen's measure of performance for Wildcat Fund.

Definitions:

Current Liabilities

Current liabilities are obligations a company must pay within one year, including accounts payable, short-term loans, and taxes owed.

Note Issuance

The process of creating and distributing a debt security or promissory note, promising to pay back a specified amount of money at a future date.

Face Amount

The nominal value of a security stated by the issuer, for example, the value printed on the face of a bond.

Interest Rate

The percentage of a loan charged by a lender to a borrower for the use of assets, typically expressed as an annual percentage rate.

Q2: Pairs trading is associated with<br>A)triangular arbitrage.<br>B)statistical arbitrage.<br>C)data

Q5: The price that the buyer of a

Q16: If the hedge ratio for a stock

Q17: Interpersonal communication has both a relationship and

Q25: In 2015, the U.S.equity market represented _

Q28: The Sharpe, Treynor, and Jensen portfolio performance

Q58: The dollar-weighted return on a portfolio is

Q71: A preferred stock will pay a dividend

Q81: The current market price of a share

Q106: The growth in dividends of Music Doctors,