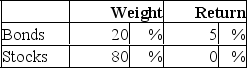

In a particular year, Razorback Mutual Fund earned a return of 1% by making the following investments in asset classes:  The return on a bogey portfolio was 2%, calculated from the following information.

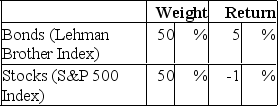

The return on a bogey portfolio was 2%, calculated from the following information. The contribution of asset allocation across markets to the Razorback Fund's total excess return was

The contribution of asset allocation across markets to the Razorback Fund's total excess return was

Definitions:

Annual Cash Flows

Annual cash flows represent the net amount of cash and cash equivalents being transferred into and out of a business in a specific fiscal year, reflecting operational, investing, and financing activities.

Required Rate Of Return

The minimum rate of return an investor expects to receive on an investment, considering the risk level and the opportunity cost of alternative investments.

Annual Cash Flows

The total amount of money being transferred into and out of a business, measured on a yearly basis.

Initial Cash Outflow

The initial expenditure involved in a project or investment, often referring to the sum of money paid at the start.

Q3: Which of the following does NOT relate

Q10: The definition "informal, casual language used among

Q12: Some of the newer futures contracts include

Q15: HighFlyer Stock currently sells for $48.A one-year

Q32: Suppose the 1-year risk-free rate of return

Q41: A good friend tells you that she

Q42: Which of the following are commonly thought

Q48: Assume that at retirement you have accumulated

Q60: The _ the proportion of total return

Q64: Suppose you buy 100 shares of Abolishing