Multiple Choice

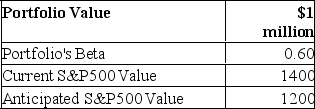

You are given the following information about a portfolio you are to manage.For the long term, you are bullish, but you think the market may fall over the next month.  For a 200-point drop in the S&P 500, by how much does the value of the futures position change?

For a 200-point drop in the S&P 500, by how much does the value of the futures position change?

Definitions:

Related Questions

Q11: A portfolio consists of 225 shares of

Q12: If the interest rate on debt is

Q16: In communication, we attempt to create shared

Q24: The process of estimating the dividends and

Q35: The intrinsic value of an in-of-the-money call

Q41: When Blake was a young child, he

Q49: Fiscal policy generally has a _ direct

Q51: Communication includes both people and messages.

Q59: A put option on a stock is

Q97: If the expected ROE on reinvested earnings