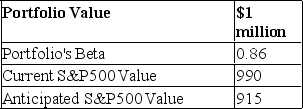

You are given the following information about a portfolio you are to manage.For the long term, you are bullish, but you think the market may fall over the next month.  How many contracts should you buy or sell to hedge your position? Allow fractions of contracts in your answer.

How many contracts should you buy or sell to hedge your position? Allow fractions of contracts in your answer.

Definitions:

Public Phase

A stage in fundraising campaigns, especially in capital campaigns of nonprofit organizations, when efforts to raise money are expanded to the general public after initial funds have been secured from major donors.

Return on Investment

Return on investment (ROI) measures the gain or loss generated on an investment relative to the amount of money invested.

Cost-Benefit Ratio

A financial analysis tool used to evaluate the relative costs and benefits of a project or investment, aiming to inform decision-making by comparing the expected sacrifices and gains.

Long-Term Fundraising

Long-term fundraising involves strategies and efforts planned over an extended period to secure resources or capital for an organization or project's future needs.

Q6: The current market price of a share

Q6: Communication is a product, not a process.

Q11: When an investor adds international stocks to

Q19: Dynamic hedging is<br>A)the volatility level for the

Q28: The prudent investor rule requires<br>A)executives of companies

Q30: The study of space and distance for

Q35: The stage an individual is in his/her

Q39: The EAFE is<br>A)the East Asia Foreign Equity

Q44: Which of the following statements regarding delivery

Q48: You purchased one AT&T March 50 put