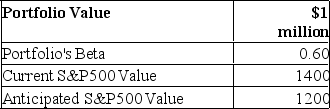

You are given the following information about a portfolio you are to manage.For the long term, you are bullish, but you think the market may fall over the next month.  If the anticipated market value materializes, what will be your expected loss on the portfolio?

If the anticipated market value materializes, what will be your expected loss on the portfolio?

Definitions:

Production Possibilities Curve

A graph that depicts the maximum feasible amounts of two commodities that a business can produce when those commodities compete for limited resources.

Technological Advance

The process of developing new technologies or improving existing ones to increase productivity or solve problems.

Soil Fertility

The ability of soil to provide essential nutrients to plants in adequate amounts for growth.

Overgrazing

The degradation of a grazing land, resulting from livestock grazing at a rate higher than the capacity of the land to regenerate.

Q2: Which item below is the best example

Q12: Suppose that the risk-free rates in the

Q19: Proximity, a characteristic of perceptual organization, refers

Q21: If you want to improve your verbal

Q25: Lookback options have payoffs that<br>A)depend in part

Q32: Suppose the price of a share of

Q48: The following data are available relating to

Q50: A portfolio consists of 800 shares of

Q77: Given a stock index with a value

Q79: An American-style call option with six months