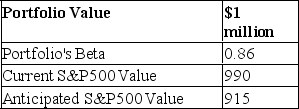

You are given the following information about a portfolio you are to manage.For the long term, you are bullish, but you think the market may fall over the next month.  For a 75-point drop in the S&P 500, by how much does the futures position change?

For a 75-point drop in the S&P 500, by how much does the futures position change?

Definitions:

Variable Interest Entity

A legal entity in which an investor holds a controlling interest due to contractual agreements rather than owning a majority of voting rights.

Residual Profits

The earnings that remain after deducting all costs, including the cost of capital, from revenues.

Debt Guarantee

An arrangement where a third party promises to assume the debt obligation of a borrower if that borrower defaults.

Investment Account

An account held by an individual or entity with a financial institution for the purpose of trading or holding investments.

Q11: The market-capitalization rate on the stock of

Q11: In an argument with another person, you

Q20: On April 1, you sold one S&P

Q22: A firm has a net profit/pretax profit

Q26: The beta of an active portfolio is

Q28: Two firms, A and B, both produce

Q28: Hedge fund performance may reflect significant compensation

Q35: Suppose two portfolios have the same average

Q82: The current market price of a share

Q104: The dividend discount model<br>A)ignores capital gains.<br>B)incorporates the