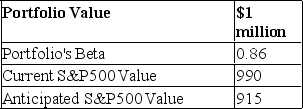

You are given the following information about a portfolio you are to manage.For the long term, you are bullish, but you think the market may fall over the next month.  How many contracts should you buy or sell to hedge your position? Allow fractions of contracts in your answer.

How many contracts should you buy or sell to hedge your position? Allow fractions of contracts in your answer.

Definitions:

Forward Contracts

A financial agreement to buy or sell an asset at a specific future date for a price agreed upon today.

Buyer

An individual or entity that acquires goods or services in exchange for payment.

Seller

An entity or individual that offers goods or services in exchange for payment, playing a crucial role in any market transaction.

Interest Rate Forward Contracts

Financial derivatives that lock in the future interest rate to be paid or received on a certain principal amount.

Q2: A firm has a lower asset turnover

Q10: Suppose the 1-year risk-free rate of return

Q13: Suppose the 1-year risk-free rate of return

Q13: Hedge fund incentive fees are essentially<br>A)put options

Q19: Unlike mutual funds, hedge funds<br>A)allow private investors

Q30: Suppose the 1-year risk-free rate of return

Q33: The Treynor-Black model assumes that<br>A)the objective of

Q48: If you took a short position in

Q52: If you determine that the DAX-30 Index

Q61: Suppose a particular investment earns an arithmetic