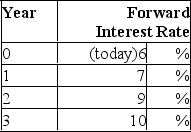

Suppose that all investors expect that interest rates for the 4 years will be as follows:  If you have just purchased a 4-year zero-coupon bond, what would be the expected rate of return on your investment in the first year if the implied forward rates stay the same? (Par value of the bond = $1,000)

If you have just purchased a 4-year zero-coupon bond, what would be the expected rate of return on your investment in the first year if the implied forward rates stay the same? (Par value of the bond = $1,000)

Definitions:

Idle Capacity

Unused or underused production capacity within a business, often leading to inefficiency and increased costs.

Time-Driven Activity-Based Costing

A costing methodology that assigns costs to products or services based on the time resources are consumed in producing them.

Customer Cost Analysis

The process of evaluating all costs associated with acquiring and serving customers to determine profitability.

Customer Service Department

A division of a business that handles customer inquiries, complaints, and provides assistance with products or services.

Q7: In periods of inflation, accounting depreciation is

Q18: Your opinion is that security A has

Q21: An overpriced security will plot<br>A)on the security

Q23: Bond stripping and bond reconstitution offer opportunities

Q27: One of the assumptions of the CAPM

Q28: Google has a beta of 1.0.The annualized

Q36: TIPS are<br>A)securities formed from the coupon payments

Q41: If the value of a Treasury bond

Q55: Two firms, C and D, both produce

Q80: A _ bond is a bond where