Multiple Choice

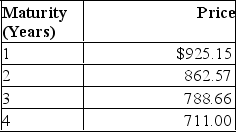

The following is a list of prices for zero-coupon bonds with different maturities and par values of $1,000.  What is the price of a 4-year maturity bond with a 10% coupon rate paid annually? (Par values = $1,000.)

What is the price of a 4-year maturity bond with a 10% coupon rate paid annually? (Par values = $1,000.)

Definitions:

Related Questions

Q6: The growth in per share FCFE of

Q8: Two basic assumptions of technical analysis are

Q16: If a firm has a required rate

Q39: Two firms, C and D, both produce

Q54: A coupon bond that pays interest semi-annually

Q63: A 6%, 30-year corporate bond was recently

Q65: The financial statements of Snapit Company are

Q80: All else equal, call option values are

Q86: A coupon bond that pays interest of

Q99: The _ is used to calculate the