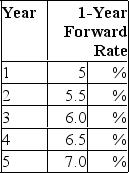

What would the yield to maturity be on a four-year zero-coupon bond purchased today?

What would the yield to maturity be on a four-year zero-coupon bond purchased today?

Definitions:

Coupon Rate

The yearly interest rate paid on a bond, shown as a percentage of its nominal value.

Interest Tax Shield

The reduction in income taxes that results from taking allowable deductions for interest expense.

Tax Shield

The reduction in income taxes that results from taking an allowable deduction from taxable income, such as mortgage interest or depreciation.

Coupon Rate

Yearly rate of interest paid on a bond, expressed in terms of percentage of its face value.

Q3: A coupon bond that pays interest annually

Q5: If the currency of your country is

Q7: The duration of a par-value bond with

Q15: The intrinsic value of an at-the-money put

Q21: A study by Speidell and Bavishi (1992)

Q22: Suppose you purchase one WFM May 100

Q23: _ are good examples of the limits

Q45: Zero had a FCFE of $4.5M last

Q57: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7045/.jpg" alt=" Given the bond

Q84: Which of the following is not a