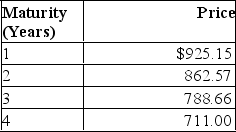

The following is a list of prices for zero-coupon bonds with different maturities and par values of $1,000.  What is the yield to maturity on a 3-year zero-coupon bond?

What is the yield to maturity on a 3-year zero-coupon bond?

Definitions:

Lawsuit Loss

Financial damages that a company is required to pay as the result of legal judgment or settlement of a lawsuit.

Probable Loss

An estimated loss from a contingent liability that is likely to occur and can be reasonably estimated.

Fair Value Option

An accounting approach allowing companies to choose to measure certain financial assets and liabilities at fair market prices.

Reporting Requirements

These refer to the specific guidelines or regulations that entities must follow when preparing and presenting their financial and operational information to regulatory bodies or the public.

Q1: The assumptions concerning the shape of utility

Q1: According to Michael Porter, there are five

Q5: A 12% coupon bond with semi-annual payments

Q16: One way that Black, Jensen and Scholes

Q18: The financial statements of Midwest Tours are

Q22: Tests of market efficiency have focused on<br>A)the

Q27: Conventional theories presume that investors _, and

Q38: Consider the single-factor APT.Stocks A and B

Q46: The intrinsic value of an in-the-money put

Q104: A coupon bond pays annual interest, has