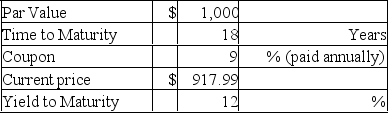

Given the bond described above, if interest were paid semi-annually (rather than annually) and the bond continued to be priced at $917.99, the resulting effective annual yield to maturity would be

Given the bond described above, if interest were paid semi-annually (rather than annually) and the bond continued to be priced at $917.99, the resulting effective annual yield to maturity would be

Definitions:

Deferred Gross Profit

The portion of gross profit that is earned but not yet recognized, often in installment sales.

Current Liability

A company's debts or obligations that are due within one year, including accounts payable, short-term loans, and other short-term financial obligations.

Deposit Method

An accounting method used when revenue cannot be recognized because the fundamental earnings process is not considered complete.

Cost Recovery Method

An accounting method where revenues are not recognized until all costs have been recovered.

Q8: If a 7.5% coupon bond that pays

Q14: Proponents of the EMH typically advocate<br>A)buying individual

Q26: SI International had a FCFE of $122.1M

Q32: Firm-specific risk is also referred to as<br>A)systematic

Q32: Music Doctors Company has an expected ROE

Q41: According to the Capital Asset Pricing Model

Q47: Two firms, C and D, both produce

Q58: A call option on a stock is

Q59: Two bonds are selling at par value,

Q68: Three years ago, you purchased a bond