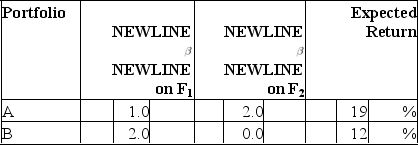

Consider the multifactor APT.There are two independent economic factors, F1andF2.The risk-free rate of return is 6%.The following information is available about two well-diversified portfolios:  Assuming no arbitrage opportunities exist, the risk premium on the factorF1portfolio should be

Assuming no arbitrage opportunities exist, the risk premium on the factorF1portfolio should be

Definitions:

Bundling

A business strategy that involves offering several products or services together as a combined package.

Wooden Board

A flat piece of wood, often used for construction, crafting, or as a cooking utensil.

Fully Dressed

The state of wearing complete attire appropriate for the occasion, leaving no part of the body indecently exposed.

Divorce

The legal dissolution of a marriage by a court or other competent body.

Q3: In developing the APT, Ross assumed that

Q13: Duration measures<br>A)weighted-average time until a bond's half-life.<br>B)weighted-average

Q20: A coupon bond that pays interest annually

Q31: Suppose the following equation best describes

Q36: An important difference between CAPM and APT

Q39: Two firms, C and D, both produce

Q46: The "normal" range of price-earnings ratios for

Q48: The most recently issued Treasury securities are

Q58: Shelf registration<br>A)is a way of placing issues

Q110: If a 6.75% coupon bond is trading