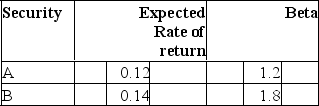

Given are the following two stocks A and B:  If the expected market rate of return is 0.09, and the risk-free rate is 0.05, which security would be considered the better buy, and why?

If the expected market rate of return is 0.09, and the risk-free rate is 0.05, which security would be considered the better buy, and why?

Definitions:

Presidential Nominee

The candidate chosen by a political party to compete for the presidency in a national election.

Caucus Method

A method of selecting political candidates or making policy decisions, usually within a political party or a legislative body, involving meetings of supporters or representatives.

Delegate Selection

The process by which political parties choose representatives (delegates) to attend their national conventions, typically through primaries or caucuses.

State Convention

A gathering or assembly at the state level, often for political, social, or educational purposes, which can involve decision-making or election processes.

Q3: The change from a straight to a

Q4: An investor invests 35% of his wealth

Q8: Which one of the following statements is

Q10: If an 8% coupon bond is trading

Q13: Duration measures<br>A)weighted-average time until a bond's half-life.<br>B)weighted-average

Q33: Assume that stock market returns do follow

Q33: Which of the following statement(s) is(are) true?

Q37: The anomalies literature<br>A)provides a conclusive rejection of

Q47: The beta of a stock has been

Q102: To earn a high rating from the