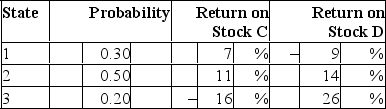

Consider the following probability distribution for stocks C and D:  The expected rates of return of stocks C and D are _____ and _____, respectively.

The expected rates of return of stocks C and D are _____ and _____, respectively.

Definitions:

Decreased Drive

A reduction in the motivation or desire to engage in particular activities.

Fluid Volume Overload

A medical condition where there is an excessive accumulation of water and salt in the body, leading to swelling and other complications.

Increased Preload

A condition where the volume of blood in the heart's ventricles before contraction (end-diastolic volume) is increased, affecting the heart's function.

Decreased Afterload

A reduction in the resistance against which the heart must pump blood, often leading to improved cardiac function.

Q3: Suppose the following equation best describes

Q5: The factor F in the APT model

Q5: In the results of the earliest estimations

Q20: In 2016, _ was(were) the most significant

Q27: Collateralized bonds<br>A)rely on the general earning power

Q32: According to the Capital Asset Pricing

Q52: When a firm markets new securities, a

Q60: The risk-free rate is 4%.The expected market

Q63: Your personal opinion is that a security

Q67: An investor purchases one municipal and one