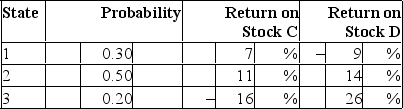

Consider the following probability distribution for stocks C and D:  The coefficient of correlation between C and D is

The coefficient of correlation between C and D is

Definitions:

Working Capital

The gap between a firm's current assets and its current liabilities, showcasing its short-term financial stability.

Annual Cash Inflow

The total amount of money received by a company over a year, including revenues from sales, investments, and other sources.

Net Present Value

An economic indicator that finds the disparity between cash inflows' present value and the present value of cash outflows during a certain period.

Discount Rate

A rate used to determine the present value of future cash flows; it's often used in discounted cash flow analysis to account for the time value of money.

Q3: A mutual fund had NAV per share

Q18: Assume that you purchased shares of a

Q27: Canada's best-known stock market indicator is<br>A)Wilshire 5000.<br>B)DJIA.<br>C)S&P/TSX

Q33: Most corporate bonds are traded<br>A)on a formal

Q35: The holding-period return (HPR) on a share

Q37: _ below which it is difficult for

Q38: Consider the single-factor APT.Stocks A and B

Q41: The premise of behavioral finance is that<br>A)conventional

Q51: Consider the following probability distribution for stocks

Q74: Consider a 5-year bond with a 10%