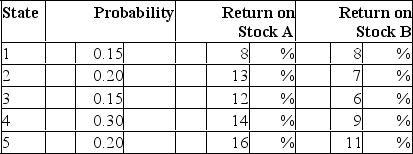

Consider the following probability distribution for stocks A and B:  The coefficient of correlation between A and B is

The coefficient of correlation between A and B is

Definitions:

Organizational Settings

The environmental and systemic context in which a company or institution operates.

Power

The ability or capacity to influence or control the behavior of others or the course of events.

Normative Power

It refers to the ability of a standard or norm to influence the behavior of individuals or groups, often through values or ethical considerations.

Strategic Function

The purposeful roles or actions designed to achieve a long-term goal or objective in planning or operations.

Q2: As a financial analyst, you are tasked

Q11: Security selection refers to<br>A)choosing which securities to

Q15: According to Roll, the only testable hypothesis

Q25: Consider the single factor APT.Portfolio A has

Q27: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7045/.jpg" alt=" What is the

Q36: An important difference between CAPM and APT

Q41: The riskiness of individual assets<br>A)should be considered

Q42: _ are balanced funds in which the

Q48: Bonds are traded<br>A)on exchanges<br>B)Over-the counter<br>C)On a venture

Q56: Consider the multifactor APT with two factors.The