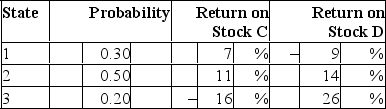

Consider the following probability distribution for stocks C and D:  The expected rates of return of stocks C and D are _____ and _____, respectively.

The expected rates of return of stocks C and D are _____ and _____, respectively.

Definitions:

WACC

The Weighted Average Cost of Capital is a metric that calculates a company's cost of capital, with each capital category being weighted proportionally.

Capital Budgeting

The process by which investors or managers decide which capital investment projects - like new machinery or expansion plans - to undertake, based on potential profitability and risk analysis.

Opportunity Cost

A cash flow that a firm must forego to accept a project. For example, if the project requires the use of a building that could otherwise be sold, the market value of the building is an opportunity cost of the project.

Overall WACC

A comprehensive measure of a company's cost of capital, incorporating the weighted costs of its equity and debt financing.

Q3: QQAG has a beta of 1.7.The annualized

Q6: Rosenberg and Guy found that _ helped

Q7: An investor will take as large a

Q12: A Treasury bill with a par value

Q12: You purchased shares of a mutual fund

Q23: A zero-coupon bond has a yield to

Q33: Of the following types of ETFs, an

Q37: A mutual fund had NAV per share

Q54: A coupon bond that pays interest semi-annually

Q71: One year ago, you purchased a newly-issued