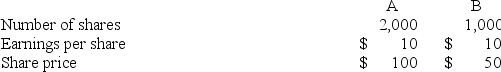

Companies A and B are valued as follows:

Company A now acquires B by offering one (new) share of A for every two shares of B (that is, after the merger, there are 2,500 shares of A outstanding) . Suppose that the merger really does increase the value of the combined firms by $20,000. . What is the cost of the merger?

Definitions:

TRIN Ratio

Also known as the Arms Index, this technical analysis indicator compares the number of advancing and declining stocks to the volume of advancing and declining stocks, used to gauge overall market sentiment.

Bearish Signal

An indication in financial markets that the price of an asset is expected to decline.

Overweighting

Refers to the practice of allocating a larger percentage of a portfolio to a particular asset or sector than the benchmark or average portfolio.

Recent Performance

Refers to the latest outcomes or results of an investment's or financial instrument's activity over a short-term period.

Q3: Harker and Keltner (2001)examined women's yearbook photos

Q6: Two in-court options for dealing with firms

Q13: What was the startling discovery that Masters

Q13: In Japan, the racketeers who demand payment

Q36: Describe the ways in which homosexuality may

Q45: The dollar interest rate is 6 percent,

Q58: The spot exchange rate for British pounds

Q61: Terry's Place is currently experiencing a bad

Q62: How do evolutionary psychologists explain gender differences?<br>A)

Q62: Huang,an 18-year-old Chinese student,and Jim,a 19-year-old American