Use the information for the question(s)below.

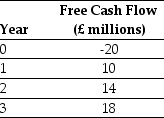

Luther Industries,a U.S.Corporation,is considering a new project located in Great Britain.The expected free cash flows from the project are detailed below:  You know that the spot exchange rate is S = 1.8862/£.In addition,the risk-free interest rate on dollars and pounds is 5.4% and 4.6% respectively.Assume that these markets are internationally integrated and the uncertainty in the free cash flow is not correlated with uncertainty in the exchange rate.You have determined that the dollar WACC for these cash flows is 10.2%.

You know that the spot exchange rate is S = 1.8862/£.In addition,the risk-free interest rate on dollars and pounds is 5.4% and 4.6% respectively.Assume that these markets are internationally integrated and the uncertainty in the free cash flow is not correlated with uncertainty in the exchange rate.You have determined that the dollar WACC for these cash flows is 10.2%.

-Calculate the pound denominated cost of capital for Luther's project.

Definitions:

Project Management Policies

Set of guidelines and protocols designed to govern project execution, ensuring consistency and alignment with organizational goals.

Project Performance

The evaluation of how effectively a project conforms to planned costs, schedules, and scope, including quality standards.

Contract Project Managers

Professionals hired on a contract basis to plan, execute, and oversee projects, ensuring they meet the specified objectives within agreed timelines and budgets.

Tolerance for Ambiguity

An individual's or organization's capacity to remain comfortable and effective in situations that are unclear, uncertain, or unpredictable.

Q3: The market value of Wyatt Oil after

Q4: What is the duration of a five-year

Q6: The equivalent annual benefit of project A

Q25: Parental monitoring is MOST likely to be

Q28: The amount of the taxes paid in

Q62: Using the equivalent annual benefit method,which project

Q64: The constant annuity payment over the life

Q95: According to Erikson,the goal of adolescence is

Q124: In David's story,although he was exposed to

Q214: Sanjay has a small dog at home,so