Use the information for the question(s)below.

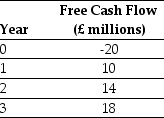

Luther Industries,a U.S.Corporation,is considering a new project located in Great Britain.The expected free cash flows from the project are detailed below:  You know that the spot exchange rate is S = 1.8862/£.In addition,the risk-free interest rate on dollars and pounds is 5.4% and 4.6% respectively.Assume that these markets are internationally integrated and the uncertainty in the free cash flow is not correlated with uncertainty in the exchange rate.You have determined that the dollar WACC for these cash flows is 10.2%.

You know that the spot exchange rate is S = 1.8862/£.In addition,the risk-free interest rate on dollars and pounds is 5.4% and 4.6% respectively.Assume that these markets are internationally integrated and the uncertainty in the free cash flow is not correlated with uncertainty in the exchange rate.You have determined that the dollar WACC for these cash flows is 10.2%.

-What is the pound present value of the project?

Definitions:

Preterm Delivery

The birth of a baby at fewer than 37 weeks' gestational age, which may pose health risks to the newborn.

Placental Insufficiency

A condition in pregnancy where the placenta fails to deliver an adequate supply of nutrients and oxygen to the fetus.

Premature Rupture of Membranes

The breaking of the amniotic sac before labor begins, potentially leading to complications.

Oligohydramnios

A condition in pregnancy characterized by a deficiency in amniotic fluid, which can lead to complications for the fetus.

Q13: Construct a binomial tree detailing the option

Q16: Consider two firms,Zoe Corporation and Marley Company.Both

Q18: What is the dollar present value of

Q21: Which of the following statements is FALSE?<br>A)In

Q21: The total cost to the firm's original

Q34: The amount of money raised by Nielson

Q44: Asset securitization is the process of creating

Q47: _ refers to the belief that family

Q155: One reason that the teenage pregnancy rate

Q165: Erikson's first _ stages are closely related