Use the following information to answer the question(s) below.

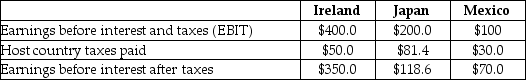

Incorporated Tool,a U.S.firm,is considering its international tax situation.The corporate tax rate in the United States is currently 21%.Incorporated Tool has major operations in Ireland,where the tax rate is 12.5%,Japan where the tax rate is 40.7%,and Mexico,where the tax rate is 30.0%.Incorporated Tool's profits,which are fully and immediately repatriated,and foreign taxes paid for the current year are as follows:

-Assuming that the Japanese and Mexican subsidiaries did not exist,the U.S.tax liability on the Irish subsidiary would be closest to:

Definitions:

Genetic

Relating to genes or heredity, the study of how traits are passed from parents to offspring through DNA.

Unconscious Processes

Mental processes that occur without conscious awareness, influencing thoughts, feelings, and behaviors.

Belongingness Need

A fundamental human motivation to be an accepted member of a group, whether it's friends, family, or within a larger community.

Ventromedial Nucleus

A region of the hypothalamus involved in regulating hunger and satiety, playing a crucial role in energy homeostasis and metabolism.

Q13: Luther Industries bills its accounts on terms

Q22: Which of the following statements is FALSE?<br>A)More

Q37: Inventory can be used as collateral for

Q57: Assuming you are able to sell the

Q84: Research has found that teens who smoke

Q103: Some parent-child bickering during the adolescent years

Q153: Steve watches his father mow the lawn.After

Q153: According to Erikson,_ identity is an arena

Q219: The science of human development seeks to

Q228: People of a specific _ group share