Use the following information to answer the question(s) below.

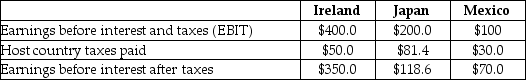

Incorporated Tool,a U.S.firm,is considering its international tax situation.The corporate tax rate in the United States is currently 21%.Incorporated Tool has major operations in Ireland,where the tax rate is 12.5%,Japan where the tax rate is 40.7%,and Mexico,where the tax rate is 30.0%.Incorporated Tool's profits,which are fully and immediately repatriated,and foreign taxes paid for the current year are as follows:

-Assuming that the Irish and Mexican subsidiaries did not exist,the U.S.tax liability on the Japanese subsidiary would be closest to:

Definitions:

Manufacturing Plant

A facility where raw materials are transformed into finished products through various processes and machinery.

Repair Process

The systematic steps or actions taken to restore a damaged or malfunctioning product, equipment, or system to its operational condition.

Manufacturing Plant

A facility where raw materials are transformed into finished products through a series of controlled processes and operations.

Repair Process

A series of actions taken to fix or restore a broken or damaged item to a condition where it can perform its intended function again.

Q4: Which of the following statements is FALSE?<br>A)Lease

Q31: Which of the following statements regarding best

Q32: Which of the following statements is FALSE?<br>A)The

Q34: Which of the following statements is FALSE?<br>A)In

Q36: If d'Anconia Copper enters into a contract

Q42: This decade is known as the conglomerate

Q113: Stubbornness is to _ as shoplifting is

Q120: The foundation of psychoanalytic theory is inner

Q123: Business is the most popular academic major.

Q129: Related to political identity is:<br>A) foreclosure.<br>B) vocational