Use the following information to answer the question(s) below.

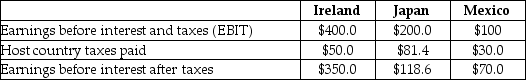

Incorporated Tool,a U.S.firm,is considering its international tax situation.The corporate tax rate in the United States is currently 21%.Incorporated Tool has major operations in Ireland,where the tax rate is 12.5%,Japan where the tax rate is 40.7%,and Mexico,where the tax rate is 30.0%.Incorporated Tool's profits,which are fully and immediately repatriated,and foreign taxes paid for the current year are as follows:

-Assuming that the Irish and Japanese subsidiaries did not exist,the U.S.tax liability on the Mexican subsidiary would be closest to:

Definitions:

Research Hypothesis

A specific, testable prediction about the relationship between at least two variables in a population, based on theory or previous research.

Independent Variable

A variable that is manipulated by the researcher to observe its effect on the dependent variable.

Research Hypothesis

A specific, clear, and testable statement predicting a particular outcome or difference based on theoretical grounds or previous research.

Power-Oriented Practices

Actions or strategies aimed at establishing, maintaining, or demonstrating power or authority within a social or organizational context.

Q27: The percentage of Wyatt's receivables that are

Q27: Which of the following statements is FALSE?<br>A)The

Q32: After the Japanese taxes are paid,the amount

Q39: Which of the following statements is FALSE?<br>A)We

Q43: What is the Yield to Call (YTC)on

Q45: The socioeconomic status of an individual includes,among

Q78: Parents of all income levels in the

Q128: The average young adult holds one to

Q183: A(n)_ is a group of people born

Q225: An example of a dependent variable in