Use the following information to answer the question(s) below.

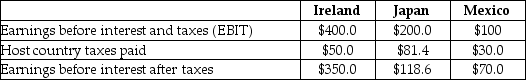

Incorporated Tool,a U.S.firm,is considering its international tax situation.The corporate tax rate in the United States is currently 21%.Incorporated Tool has major operations in Ireland,where the tax rate is 12.5%,Japan where the tax rate is 40.7%,and Mexico,where the tax rate is 30.0%.Incorporated Tool's profits,which are fully and immediately repatriated,and foreign taxes paid for the current year are as follows:

-Incorporated Tools' total U.S.tax liability on its foreign earnings is closest to:

Definitions:

Earnings per Share

A company's net profit divided by the number of its outstanding shares, indicating the profitability on a per-share basis.

Dividend Payout Ratio

The portion of net income distributed to shareholders in the form of dividends, expressed as a percentage of the company's total net income.

Book Value per Share

A financial measure that indicates the theoretical value per share of a company if it were to liquidate, calculated by dividing total equity by the number of outstanding shares.

Price-earnings Ratio

A valuation metric for companies, calculated by dividing the current market price of a stock by its earnings per share (EPS).

Q13: What is the role of takeovers in

Q17: If Rearden offers an exchange ratio such

Q22: The Black-Scholes value of a one-year,at-the-money call

Q46: The amount of money the underwriter will

Q97: Following Erikson's lead,_ distinguished four specific ways

Q112: _ is an example of "identity foreclosure."<br>A)

Q149: A person observes the actions of others

Q172: Debbie was born during the Great Depression.Within

Q178: The influence of nurture begins at conception.

Q194: To be ethical,researchers should choose topics of