Use the following information to answer the question(s) below.

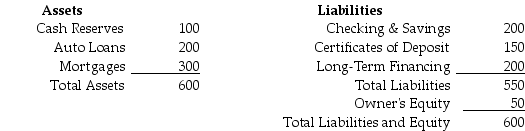

You are a risk manager for Security First Trust Savings and Loan (SFTSL) .SFTSL's balance sheet is as follows (in millions of dollars) :  The duration of the auto loans is three years and the duration of the mortgages is eight years.Both cash reserves and checking and savings have zero duration.The CDs have a duration of two years and the long-term financing has a ten-year duration.

The duration of the auto loans is three years and the duration of the mortgages is eight years.Both cash reserves and checking and savings have zero duration.The CDs have a duration of two years and the long-term financing has a ten-year duration.

-If interest rates are currently 5%,but fall to 4%,your estimate of the approximate change in SFTSL equity is closest to:

Definitions:

Baby Boomer Generation

The Baby Boomer generation refers to people born during the post-World War II baby boom between 1946 and 1964, known for their significant impact on the economy and culture.

Pension Plan

A retirement plan that requires an employer to contribute to a pool of funds set aside for a worker's future benefit.

Cost-of-Living Adjustment

An increase in income or benefits to match the rise in the cost of living, helping individuals maintain their purchasing power.

Salary

A fixed regular payment, typically paid on a monthly or biweekly basis but often expressed as an annual sum, made by an employer to an employee.

Q18: Luther's accounts receivable days is closest to:<br>A)42

Q22: Which of the following statements is FALSE?<br>A)More

Q35: Consider the following equation: S × <img

Q37: Which of the following statements is FALSE?<br>A)There

Q38: Which of the following statements regarding vertical

Q46: What kind of corporate debt must be

Q47: Which of the following does NOT issue

Q59: Parasuicide refers to:<br>A) a suicide attempt that

Q154: Dr.Branson is interested in whether adults value

Q251: James told his friend that he is