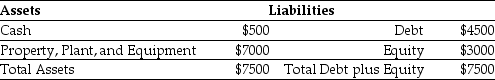

Use the table for the question(s) below.

Luther Industries currently has the following balance sheet (in thousands of dollars) :  Luther is about to add a new fleet of delivery trucks.The price of the fleet is $1.5 million.

Luther is about to add a new fleet of delivery trucks.The price of the fleet is $1.5 million.

-If Luther acquires the new fleet of delivery trucks using a capital lease,Luther's Debt to Equity ratio will be closest to:

Definitions:

Forward Contract

A financial derivative that represents a customized contract between two parties to buy or sell an asset at a specified price on a future date.

Carrying Value

The book value of assets and liabilities, reflecting their recorded cost minus any depreciation, amortization, or impairment charges.

Spot Rate

The price at which a financial instrument or commodity can be bought or sold for immediate delivery, emphasizing current market value.

Fair Value Hedge

A hedge that protects against changes in the fair value of assets, liabilities, or unrecognized firm commitments.

Q8: Which of the following statements is FALSE?<br>A)The

Q11: Which of the following statements is FALSE?<br>A)Under

Q14: With the proper changes it is believed

Q24: Theorists who promote classical conditioning believe that

Q28: Bonds issued by a local entity,denominated in

Q30: Based upon the average EV/EBITDA ratio of

Q34: What conclusions can you make about the

Q40: The idea that after making a large

Q41: If Wyatt Oil distributes the $70 million

Q43: Which of the following firms is likely