Use the information for the question(s)below.

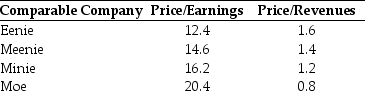

During the most recent fiscal year,KD Industries had revenues of $400 million and earnings of $30 million.KD has filed a registration statement with the SEC for its IPO.Before it is offered,KD's investment bankers would like to estimate the value of the company using comparable companies.The investment bankers have assembled the following information based on data for other companies in the same industry that have recently gone public.In each case,the ratios are based upon the IPO price.

-Based upon the price/earnings ratio,what would be a reasonable value for KD?

Definitions:

Q1: You pay $3.25 for a call option

Q12: Assume that in the event of default,20%

Q18: Galt's WACC is closest to:<br>A)6.0%.<br>B)9.6%.<br>C)11.1%.<br>D)10.7%.

Q20: The present value of Rearden Metal's cash

Q22: Omicron's unlevered cost of capital is closest

Q23: Describe "just-in-time" inventory management.

Q31: Wyatt Oil has an issue of commercial

Q39: Which of the following statements is FALSE?<br>A)Global

Q39: Consider the following equation: S × <img

Q125: IRB stands for:<br>A) Institutional Review Board.<br>B) International