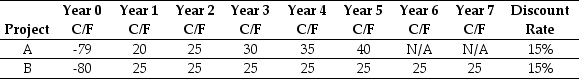

Use the table for the question(s) below.

Consider the following mutually exclusive projects:

-The NPV of project B is closest to:

Definitions:

ANOVA Table

A table used in analysis of variance to summarize the sources of variation and associated statistical tests.

F-ratio

The F-ratio is a statistic used to compare the variance among group means in an ANOVA test, helping determine if there are any statistically significant differences between the means of three or more unrelated groups.

P-value

A statistical metric indicating the probability of observing the results of a test, or more extreme, under the assumption that the null hypothesis is true.

SSE

Sum of Squared Errors, a measure used in statistics to describe the total deviation of predicted values from the actual values in a dataset.

Q2: Which of the following statements is FALSE?<br>A)The

Q3: Can value can be created by waiting

Q26: Occasionally,a company will encounter circumstances in which

Q30: The present value of Rearden Metal's cash

Q46: The debt capacity for Omicron's new project

Q49: Suppose that d'Anconia Copper retained the $200

Q60: The effective dividend tax rate in 1999

Q82: What is the expected payoff to debt

Q85: Suppose that BBB pays corporate taxes of

Q93: Which of the following is NOT a