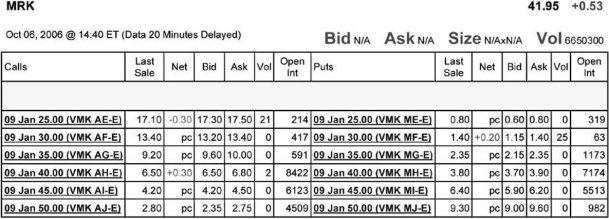

Use the table for the question(s)below.

Consider the following information on options from the CBOE for Merck:

-You have decided to sell (write)five January 2009 put options on Merck with an exercise price of $45 per share.How much money will you receive and are these contracts in or out of the money?

Definitions:

Significant Influence

The power to participate in the financial and operating policy decisions of an investee, but not control them, typically associated with ownership of 20%-50% of voting stock.

IAS 28

An International Accounting Standard that prescribes the accounting for investments in associates and sets the requirements for the application of the equity method when accounting for investments in associates and joint ventures.

Non-Strategic Investments

Investments made by a company that are not part of its core operations or strategic plan.

Significant Influence Investments

Investments where the investor has the power to participate in the financial and operating policy decisions of the investee but does not control or jointly control the entity.

Q1: Which of the following statements regarding sinking

Q4: Describe the two factors that affect the

Q5: What range for the market value of

Q8: The percentage of Wyatt's receivables that are

Q12: Raceway Products has a market debt-to-equity ratio

Q21: The value of Luther with leverage is

Q29: In order for Nielson Motors to be

Q37: The NPV for Omicron's new project is

Q37: The income that would be available to

Q38: Which of the following statements is FALSE?<br>A)Creditors