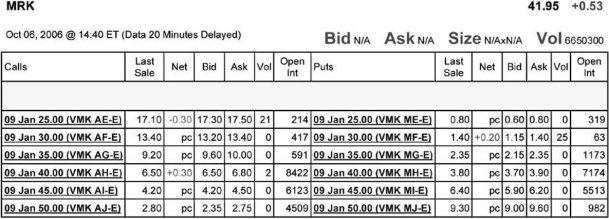

Use the table for the question(s)below.

Consider the following information on options from the CBOE for Merck:

-You have decided to buy ten January 2009 call options on Merck with an exercise price of $45 per share.How much will this transaction cost and are these contracts in or out of the money?

Definitions:

Benefits

Advantages or gains, often related to employment, insurance, or social welfare programs.

Costs

The expenses incurred in the production of goods or in the provision of services, measured in terms of money, time, or other resources.

Emergency Contraceptives

Medications or devices used to prevent pregnancy after unprotected sex or contraceptive failure.

Divorce Rates

The statistical measure of how often divorce occurs within a population, typically expressed per 1000 marriages.

Q15: Assume that EGI decides to raise the

Q20: Luther Industries wants to borrow $1 million

Q24: Nielson's estimated equity beta is closest to:<br>A)0.95.<br>B)1.00.<br>C)1.25.<br>D)1.45.

Q26: Which of the following statements is FALSE?<br>A)An

Q30: Wyatt Oil purchases goods from its suppliers

Q44: What is Rearden's earnings per share after

Q46: Which of the following statements is FALSE?<br>A)The

Q54: Assuming Luther issues a 5:2 stock split,then

Q84: Galt Industries has 125 million shares outstanding

Q106: Suppose that the managers at Rearden Metal